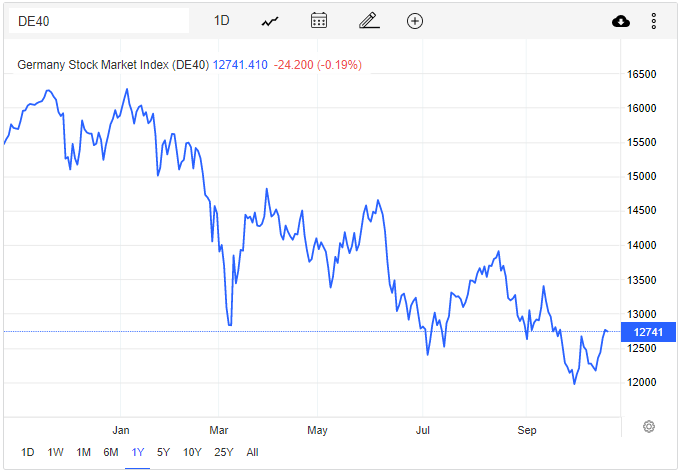

On Thursday, European markets were expected to open weakly, continuing a worldwide stock selloff fuelled by rising bond yields and increased economic uncertainty. Investors feared that continued monetary tightening and soaring inflation would push the world economy into a recession. The hope for increased corporate profits and the positive mood brought on by the UK’s policy changes also started to wane. Early trading saw a 0.3% decline in the DAX futures and a 0.2% decline in the Stoxx 600 futures.

Highs and low’s of the European Markets biggest index.

Visit Swap Hunter and see our prices

Don’t miss out on any of our awesome features and inclusive Training Sessions. If you are looking for the best value for you or your Investors, the Expert Package is the best option.

Free up your Time and increase your multi asset Investment Equity. The Professional Package is perfect when you’re ready to take full advantage of Carry/Swap Trading.

Join the Swap Hunter Community! If you are already trading and looking for an Edge over the Market, the Standard Package is an excellent option.