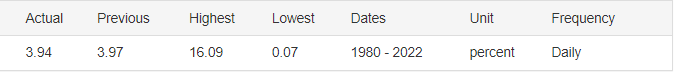

The yield on Britain’s 10-year bond stabilized at approximately 3.9%, remaining far below the 14-year high of 4.6% recorded on October 12th as the UK government’s decision to reverse course on a sizable unfunded fiscal stimulus looked to bolster investors’ confidence. The basic rate of income tax will decrease from 20% to 19% starting in April of next year, according to new chancellor Jeremy Hunt, who stated on Monday that he was reversing practically all tax reforms proposed in the mini-budget that have not yet begun parliamentary legislation. The Financial Times reported that another postponement was probable due to the recent chaos in the markets, but the Bank of England maintained that the launch of its government bond auctions is poised to go ahead as planned.