The struggle of Traders

As a retail trader, trading with Forex brokers can be a daunting task. Despite the promises of high returns and the potential for financial freedom, the reality is that the game is rigged against the average trader. Forex brokers are in the business of making money, and they will always win, even when clients are making money.

Forex brokers often have a business model that prioritizes their own profits over their clients' success. By adding negative swaps that can make it more costly to hold trades for longer periods due to the overnight fees known as Swaps. This lack of transparency in the Forex market can make it difficult for traders to make informed decisions and ultimately leads to losses, especially for new traders who are just starting out.

Traders must be aware of the costs of Forex trading, this is one reason why we developed our software and service.

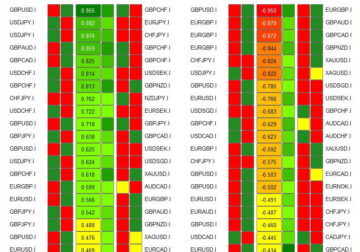

And also so traders can use our hedging strategies with correlated assets to lower risks and to make money on the overnight fee/swaps.

Swap Hunter: The Champion for Forex Traders

Your gateway to a new era of Forex trading where we arm you with the tools to outsmart the market and the brokers.

Trading is not just a game of numbers; it's a strategic dance, and we're here to make sure you lead at least with one step.

Swap Hunter isn't just an analytical tool; it's your secret weapon against the tactics employed by CFD brokers. Picture this: as you engage in trading, aiming to maximize profits on holding profitable positions, brokers are often lurking, ready to eat into your hard-earned gains with charges and inflated overnight swap rates. It's a common battle traders face, but Swap Hunter is your shield in this financial warfare.

Our tool not only provides valuable insights into the intricacies of carry trading but also equips you to navigate the treacherous waters of overnight swaps. These swaps can be the hidden landmines that erode your profits, but with Swap Hunter, you gain a tactical advantage. Stay ahead of the game by understanding how to make overnight swaps work for you, not against you.

We get it – CFD brokers try to eat into your profits with charges and sneaky tactics. Swap Hunter is your ally, ensuring that you don't become an easy target. Our mission is to empower you with the knowledge and tools needed to turn the tables. Take control of your trades, mitigate the impact of overnight swap charges, and let your profits flourish.

Join Swap-Hunter.com today, where we're not just helping you trade; we're helping you win. Beat the brokers at their own game, reclaim control over your profits, and make every trade a step towards financial empowerment. Your success in carry trading is not just a possibility – it's a promise with Swap Hunter by your side.

Benefits at a glance

Earn profits on the overnight swaps

Designed for

Long-Term Investors

can benefit from earning swaps by holding positions for extended periods and staying hedged to reduce risks. By using 'Swap Hunter', they can analyze the swaps offered by various brokers and choose the one that provides the best returns. Additionally, they can use the tool to monitor their positions and ensure that they remain hedged to avoid losses. Ultimately, earning swaps can be a valuable source of passive income for long-term investors in the Forex market.

Novice Traders

can minimize risks and make informed decisions. Swap Hunter analyzes currency pairs to find those that offer the highest overnight swaps. By identifying these currency pairs, 'Swap Hunter' gives traders an edge over the market. With the right skills, knowledge, and experience, traders can make informed decisions and achieve financial freedom. AWith the help of this tool, novice traders can gain confidence in their trades and reduce the risks associated with Forex trading.

Forex scalpers and day traders

can use 'Swap Hunter' to analyze currency pairs, traders can identify those with the best overnight swaps, which can help them maximize profits in the short term while minimizing the cost of holding trades. Additionally, 'Swap Hunter' can monitor positions to ensure that they remain hedged and avoid losses. With 'Swap Hunter', Forex scalpers and day traders can gain an edge over the market and brokers and achieve financial freedom in the short term.

PAMM/MAM managers

have a responsibility to secure their clients' funds and generate steady mid- and long-term profits. By using 'Swap Hunter' to analyze currency pairs, managers can find those with the best overnight swaps, which can help maximize profits while minimizing the cost of holding trades. Additionally, they can monitor positions to ensure that they remain hedged and avoid losses, reducing the risk of losing clients' funds.

Ways to use Carry Trading to generate profits

Investment Strategy "Hold the hedge"

Strategy suitable for Investing with focus on capital preservation. Build up profits steady and beat inflation by collecting the overnight swaps and the weekly triple rollover. Lower the risks of trading in the financial markets significantly through hedging.

Investment Strategy "Release the Hedge"

Strategy for experienced traders, who are looking for higher profits. Generate quicker and higher returns but with higher risk. Profit from accumulated Swaps and banking profits on the winning side of the hedge. Then recovering the losses from losing side of the hedge.

New option: Swap Hunter PAMM

We have created a PAMM investment account for Investors without previous trading experience. The Swap Hunter PAMM is utilising all the Carry Trading strategies: Hold the Hedge, release the hedge and tripple rollover, banking Profits and let the P&L float.

Get your Edge over the Market

Testimonials

Senior Manager, PAMM Investor

"I was looking for a good investment opportunity in a low interest market. With no experience in Forex or trading. I prefer slow and steady returns, which Swap Hunter provide. Protecting my equity against inflation is my priority and gain a little extra interest."

Professional Trader

"Carry trading is not new, but with Swap Hunter it is easier than ever to facilitate this strategy. It is used by institutional level investors and the banks. I've not seen a tool like this for MT4 and it is very powerful, if you implement it in your investment portfolio"

Joao Monteiro

CEO 4XC.com

"Partnering up with Swap Hunter has proven to be extremely successful. As we see traders looking for alternative trading techniques and styles, Swap Hunter provide some of the best tools for this. We can give our traders swap correlation, carry trading indicators and much more. "

Strong combination of MT4 indicators

Included in the Swap Hunter MetaTrader 4 package

The Turkish lira

The Turkish lira kept falling, reaching a new record low of 23.5 per USD. This brought the monthly loss to 13% and the overall depreciation since the runoff election on May 28th to nearly 18%. President Tayyip Erdogan named Hafize Gaye Erkan, formerly a co-CEO at First Republic Bank and a managing director at Goldman … Read more

Rising Bond Yields

Rising Bond Yields Government bond yields rising globally as investors predicted that high inflation pressures would keep interest rates high. While the Federal Reserve is anticipated to deliver another boost by July, the Reserve Bank of Australia and the Bank of Canada both surprised markets with a 25bps interest rate increase this week. Trade this … Read more

China Exports Tank

China Exports Tank In May 2023, China Exports Tank 7.5% year over year to USD 283.5 billion, reversing an 8.5% gain in April and signaling the first reduction since February and the sharpest drop in four months. As a result of insufficient worldwide demand, the most recent print was worse than the market forecast of … Read more

European Economy

Will the European Economy improve? Following a downwardly revised 10.9% decline in March, factory orders in Germany unexpectedly fell by 0.4% in April 2023, missing market expectations of a 3.0% increase. This affected the European Economy. The dip in industrial orders, which was mostly caused by a drop in large-scale orders, continued for the second … Read more

US Jobs Data and NFP

US Jobs Data and NFP It is the US Jobs Data and NFP release today. Following a jump of 253K in April, the US economy is predicted to have added 190K jobs in May 2023, which would be the second-lowest record since December 2020. The industries of leisure and hospitality are projected to have added … Read more

China Manufacturing PMI

The NBS Manufacturing PMI missed market expectations and dropped to a five-month low of 48.8 in May 2023 from 49.2 in April. The most recent data indicated that manufacturing activity had decreased for a second month in a row due to weak domestic and international demand. For the first time in four months, output decreased … Read more

United States Debt Deal

United States Debt Deal As a result of the expectation that Congress will approve the debt deal, the yield on the US 10-year Treasury note dropped to 3.73% from 3.85% the previous week. In a late-Saturday phone chat, House Speaker McCarthy and President Biden came to a tentative agreement. Federal expenditure will be limited for … Read more

US Inflation

US Inflation The Federal Reserve’s hawkish signals and increased optimism regarding the debt ceiling negotiations supported the dollar index’s recent gain to approximately 103.5 today, which is hovering at its highest level in two months. The dollar index has also risen by roughly 0.8% so far this week. It is expected to continue rising this … Read more

Carry Trading

CARRY TRADING Beat the banks and brokers with their own weapons Stop losing money on forex trading, but benefit daily from swaps with Swap Hunter! Use our powerful MT4 indicators: Find correlated Asset pairs Earn Interest on the daily rollover Protect capital through hedging Swap Hunter is a MetaTrader 4 Indicator, you can download MT4 here. Our correlation … Read more