The struggle of Traders

As a retail trader, trading with Forex brokers can be a daunting task. Despite the promises of high returns and the potential for financial freedom, the reality is that the game is rigged against the average trader. Forex brokers are in the business of making money, and they will always win, even when clients are making money.

Forex brokers often have a business model that prioritizes their own profits over their clients' success. By adding negative swaps that can make it more costly to hold trades for longer periods due to the overnight fees known as Swaps. This lack of transparency in the Forex market can make it difficult for traders to make informed decisions and ultimately leads to losses, especially for new traders who are just starting out.

Traders must be aware of the costs of Forex trading, this is one reason why we developed our software and service.

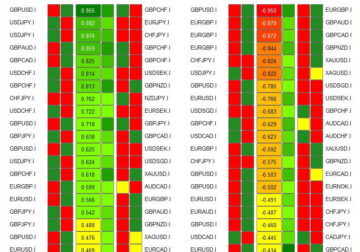

And also so traders can use our hedging strategies with correlated assets to lower risks and to make money on the overnight fee/swaps.

Swap Hunter: The Champion for Forex Traders

Your gateway to a new era of Forex trading where we arm you with the tools to outsmart the market and the brokers.

Trading is not just a game of numbers; it's a strategic dance, and we're here to make sure you lead at least with one step.

Swap Hunter isn't just an analytical tool; it's your secret weapon against the tactics employed by CFD brokers. Picture this: as you engage in trading, aiming to maximize profits on holding profitable positions, brokers are often lurking, ready to eat into your hard-earned gains with charges and inflated overnight swap rates. It's a common battle traders face, but Swap Hunter is your shield in this financial warfare.

Our tool not only provides valuable insights into the intricacies of carry trading but also equips you to navigate the treacherous waters of overnight swaps. These swaps can be the hidden landmines that erode your profits, but with Swap Hunter, you gain a tactical advantage. Stay ahead of the game by understanding how to make overnight swaps work for you, not against you.

We get it – CFD brokers try to eat into your profits with charges and sneaky tactics. Swap Hunter is your ally, ensuring that you don't become an easy target. Our mission is to empower you with the knowledge and tools needed to turn the tables. Take control of your trades, mitigate the impact of overnight swap charges, and let your profits flourish.

Join Swap-Hunter.com today, where we're not just helping you trade; we're helping you win. Beat the brokers at their own game, reclaim control over your profits, and make every trade a step towards financial empowerment. Your success in carry trading is not just a possibility – it's a promise with Swap Hunter by your side.

Benefits at a glance

Earn profits on the overnight swaps

Designed for

Long-Term Investors

can benefit from earning swaps by holding positions for extended periods and staying hedged to reduce risks. By using 'Swap Hunter', they can analyze the swaps offered by various brokers and choose the one that provides the best returns. Additionally, they can use the tool to monitor their positions and ensure that they remain hedged to avoid losses. Ultimately, earning swaps can be a valuable source of passive income for long-term investors in the Forex market.

Novice Traders

can minimize risks and make informed decisions. Swap Hunter analyzes currency pairs to find those that offer the highest overnight swaps. By identifying these currency pairs, 'Swap Hunter' gives traders an edge over the market. With the right skills, knowledge, and experience, traders can make informed decisions and achieve financial freedom. AWith the help of this tool, novice traders can gain confidence in their trades and reduce the risks associated with Forex trading.

Forex scalpers and day traders

can use 'Swap Hunter' to analyze currency pairs, traders can identify those with the best overnight swaps, which can help them maximize profits in the short term while minimizing the cost of holding trades. Additionally, 'Swap Hunter' can monitor positions to ensure that they remain hedged and avoid losses. With 'Swap Hunter', Forex scalpers and day traders can gain an edge over the market and brokers and achieve financial freedom in the short term.

PAMM/MAM managers

have a responsibility to secure their clients' funds and generate steady mid- and long-term profits. By using 'Swap Hunter' to analyze currency pairs, managers can find those with the best overnight swaps, which can help maximize profits while minimizing the cost of holding trades. Additionally, they can monitor positions to ensure that they remain hedged and avoid losses, reducing the risk of losing clients' funds.

Ways to use Carry Trading to generate profits

Investment Strategy "Hold the hedge"

Strategy suitable for Investing with focus on capital preservation. Build up profits steady and beat inflation by collecting the overnight swaps and the weekly triple rollover. Lower the risks of trading in the financial markets significantly through hedging.

Investment Strategy "Release the Hedge"

Strategy for experienced traders, who are looking for higher profits. Generate quicker and higher returns but with higher risk. Profit from accumulated Swaps and banking profits on the winning side of the hedge. Then recovering the losses from losing side of the hedge.

New option: Swap Hunter PAMM

We have created a PAMM investment account for Investors without previous trading experience. The Swap Hunter PAMM is utilising all the Carry Trading strategies: Hold the Hedge, release the hedge and tripple rollover, banking Profits and let the P&L float.

Get your Edge over the Market

Testimonials

Senior Manager, PAMM Investor

"I was looking for a good investment opportunity in a low interest market. With no experience in Forex or trading. I prefer slow and steady returns, which Swap Hunter provide. Protecting my equity against inflation is my priority and gain a little extra interest."

Professional Trader

"Carry trading is not new, but with Swap Hunter it is easier than ever to facilitate this strategy. It is used by institutional level investors and the banks. I've not seen a tool like this for MT4 and it is very powerful, if you implement it in your investment portfolio"

Joao Monteiro

CEO 4XC.com

"Partnering up with Swap Hunter has proven to be extremely successful. As we see traders looking for alternative trading techniques and styles, Swap Hunter provide some of the best tools for this. We can give our traders swap correlation, carry trading indicators and much more. "

Strong combination of MT4 indicators

Included in the Swap Hunter MetaTrader 4 package

Japan trade balance

Japan trade balance From JPY 854.9 billion in April 2022 to JPY 432.4 billion in April 2023, Japan trade balance decreased, falling short of market estimates of a JPY 613.8 billion deficit. The series of 21 months without a trade surplus was the longest since 2015. Exports increased by 2.6% year over year at JPY 8,288.4 … Read more

European equity markets

European equity markets In anticipation of a compromise between US President Joe Biden and congressional leaders to lift the US debt ceiling and prevent a default, European equity markets were set to open higher on Thursday, extending a global surge. However, investors anticipate earnings announcements from companies including Vantage Towers, BT Group, Burberry, EasyJet, and Premier Foods … Read more

United Kingdom Interest Rate

As it continues to fight double-digit inflation, the Bank of England is anticipated to hike the United Kingdom interest rate by 25 basis points to 4.5% in May 2023. This will be the eleventh consecutive rate increase and drive borrowing rates to new highs not seen since 2008. In March, the UK’s annual inflation rate … Read more

Germany industrial production

In March 2023, Germany industrial production fell 3.4% month-over-month, reversing a 2.1% increase in February that had been upwardly corrected, and worse than the 1.3% decline predicted by the market. The manufacturing of motor vehicles and their components fell 6.5%, following a 6.9% increase in February, making the automotive industry the biggest drag. Construction (-4.6%), … Read more

Biden polls behind Trump

Biden polls behind Trump (45-38%) & DeSantis (42-37%) in head-to-head matchups, although there are large numbers of undecided voters. >60% of Americans think Biden does not have the physical stamina to serve effectively as president. What do you do? You register with us and we tell you exactly how you manage these risks Click here … Read more

The ISM Services PMI increased to 51.9 in April of 2023 from 51.2 in March

The ISM Services PMI increased to 51.9 in April of 2023 from 51.2 in March, and slightly higher than market expectations of 51.8. It marks a fourth consecutive month of growth in the services sector, prompted by a faster increase in new orders (56.1 vs 52.2), a rebound in new export orders (60.9 vs 43.7) … Read more

The US annual inflation rate decreased for the ninth consecutive month

Inflation rate decreased 6% in February to 5% in March 2023, which was below market expectations of 5.2% and the lowest level since May 2021. Food prices increased less quickly than they did in February (9.5% vs. 8.5%), while energy costs decreased (-6.4% vs. +5.2%), particularly for gasoline (-17.4%) and fuel oil (-14.2%). The cost … Read more

United States Inflation Rate

As the results of the midterm elections began to come in on Wednesday, US stock futures fluctuated between modest gains and losses. Although the contest is still close and the vote count is ongoing, Republicans are probably going to take the House while Democrats are going to maintain the Senate. Stocks continued to rise in … Read more

United States Stock Market Index

As the results of the midterm elections began to come in on Wednesday, United States stock market fluctuated between modest gains and losses. Although the contest is still close and the vote count is ongoing, Republicans are probably going to take the House while Democrats are going to maintain the Senate. Stocks continued to rise … Read more