The struggle of Traders

As a retail trader, trading with Forex brokers can be a daunting task. Despite the promises of high returns and the potential for financial freedom, the reality is that the game is rigged against the average trader. Forex brokers are in the business of making money, and they will always win, even when clients are making money.

Forex brokers often have a business model that prioritizes their own profits over their clients' success. By adding negative swaps that can make it more costly to hold trades for longer periods due to the overnight fees known as Swaps. This lack of transparency in the Forex market can make it difficult for traders to make informed decisions and ultimately leads to losses, especially for new traders who are just starting out.

Traders must be aware of the costs of Forex trading, this is one reason why we developed our software and service.

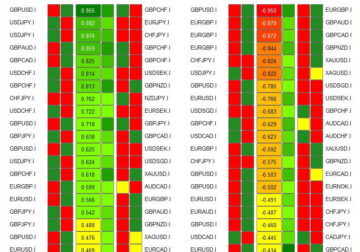

And also so traders can use our hedging strategies with correlated assets to lower risks and to make money on the overnight fee/swaps.

Swap Hunter: The Champion for Forex Traders

Your gateway to a new era of Forex trading where we arm you with the tools to outsmart the market and the brokers.

Trading is not just a game of numbers; it's a strategic dance, and we're here to make sure you lead at least with one step.

Swap Hunter isn't just an analytical tool; it's your secret weapon against the tactics employed by CFD brokers. Picture this: as you engage in trading, aiming to maximize profits on holding profitable positions, brokers are often lurking, ready to eat into your hard-earned gains with charges and inflated overnight swap rates. It's a common battle traders face, but Swap Hunter is your shield in this financial warfare.

Our tool not only provides valuable insights into the intricacies of carry trading but also equips you to navigate the treacherous waters of overnight swaps. These swaps can be the hidden landmines that erode your profits, but with Swap Hunter, you gain a tactical advantage. Stay ahead of the game by understanding how to make overnight swaps work for you, not against you.

We get it – CFD brokers try to eat into your profits with charges and sneaky tactics. Swap Hunter is your ally, ensuring that you don't become an easy target. Our mission is to empower you with the knowledge and tools needed to turn the tables. Take control of your trades, mitigate the impact of overnight swap charges, and let your profits flourish.

Join Swap-Hunter.com today, where we're not just helping you trade; we're helping you win. Beat the brokers at their own game, reclaim control over your profits, and make every trade a step towards financial empowerment. Your success in carry trading is not just a possibility – it's a promise with Swap Hunter by your side.

Benefits at a glance

Earn profits on the overnight swaps

Designed for

Long-Term Investors

can benefit from earning swaps by holding positions for extended periods and staying hedged to reduce risks. By using 'Swap Hunter', they can analyze the swaps offered by various brokers and choose the one that provides the best returns. Additionally, they can use the tool to monitor their positions and ensure that they remain hedged to avoid losses. Ultimately, earning swaps can be a valuable source of passive income for long-term investors in the Forex market.

Novice Traders

can minimize risks and make informed decisions. Swap Hunter analyzes currency pairs to find those that offer the highest overnight swaps. By identifying these currency pairs, 'Swap Hunter' gives traders an edge over the market. With the right skills, knowledge, and experience, traders can make informed decisions and achieve financial freedom. AWith the help of this tool, novice traders can gain confidence in their trades and reduce the risks associated with Forex trading.

Forex scalpers and day traders

can use 'Swap Hunter' to analyze currency pairs, traders can identify those with the best overnight swaps, which can help them maximize profits in the short term while minimizing the cost of holding trades. Additionally, 'Swap Hunter' can monitor positions to ensure that they remain hedged and avoid losses. With 'Swap Hunter', Forex scalpers and day traders can gain an edge over the market and brokers and achieve financial freedom in the short term.

PAMM/MAM managers

have a responsibility to secure their clients' funds and generate steady mid- and long-term profits. By using 'Swap Hunter' to analyze currency pairs, managers can find those with the best overnight swaps, which can help maximize profits while minimizing the cost of holding trades. Additionally, they can monitor positions to ensure that they remain hedged and avoid losses, reducing the risk of losing clients' funds.

Ways to use Carry Trading to generate profits

Investment Strategy "Hold the hedge"

Strategy suitable for Investing with focus on capital preservation. Build up profits steady and beat inflation by collecting the overnight swaps and the weekly triple rollover. Lower the risks of trading in the financial markets significantly through hedging.

Investment Strategy "Release the Hedge"

Strategy for experienced traders, who are looking for higher profits. Generate quicker and higher returns but with higher risk. Profit from accumulated Swaps and banking profits on the winning side of the hedge. Then recovering the losses from losing side of the hedge.

New option: Swap Hunter PAMM

We have created a PAMM investment account for Investors without previous trading experience. The Swap Hunter PAMM is utilising all the Carry Trading strategies: Hold the Hedge, release the hedge and tripple rollover, banking Profits and let the P&L float.

Get your Edge over the Market

Testimonials

Senior Manager, PAMM Investor

"I was looking for a good investment opportunity in a low interest market. With no experience in Forex or trading. I prefer slow and steady returns, which Swap Hunter provide. Protecting my equity against inflation is my priority and gain a little extra interest."

Professional Trader

"Carry trading is not new, but with Swap Hunter it is easier than ever to facilitate this strategy. It is used by institutional level investors and the banks. I've not seen a tool like this for MT4 and it is very powerful, if you implement it in your investment portfolio"

Joao Monteiro

CEO 4XC.com

"Partnering up with Swap Hunter has proven to be extremely successful. As we see traders looking for alternative trading techniques and styles, Swap Hunter provide some of the best tools for this. We can give our traders swap correlation, carry trading indicators and much more. "

Strong combination of MT4 indicators

Included in the Swap Hunter MetaTrader 4 package

Stop loosing money on forex trading, earn daily swaps.

Use our powerful MT4 ‘Carry Trading’ indicators: Find correlated Asset pairs Earn Interest on the daily rollover Protect capital through hedging Get your Edge over your Brokerage Take your forex trading to the next level with the Swap Hunter system. Institutional level indicators, second to none support and training for our clients who want to … Read more

Elon Musk’s Weird Week: Joking With A Former Russian President, Memes With Kanye And Trump, And A Potential Federal Investigation

Elon Musk Memes With Kanye, Putin And Trump . Also facing Potential Federal Investigation Elon Musk, the richest man in the world, had yet another eventful week, hanging out with Kanye West despite the rapper receiving criticism for a string of anti-Semitic remarks, exchanging jabs with Dmitry Medvedev, the former president of Russia, and possibly … Read more

European markets selloff

On Thursday, European markets were expected to open weakly, continuing a worldwide stock selloff fuelled by rising bond yields and increased economic uncertainty. Investors feared that continued monetary tightening and soaring inflation would push the world economy into a recession. The hope for increased corporate profits and the positive mood brought on by the UK’s … Read more

Nasdaq 100 Futures Rises

The Nasdaq 100 futures rises 1.5% The Nasdaq 100 Futures rises 1.5% on Wednesday after Netflix surged in late trading on better-than-expected results. US stock futures also increased. S&P 500 futures increased by 1%, and Dow futures increased by 0.6%. Due to excellent subscriber growth, beating earnings and revenue expectations, and prolonged trading, Netflix increased … Read more

United Kingdom Government Bond 10Y

The yield on Britain’s 10-year bond stabilized at approximately 3.9%, remaining far below the 14-year high of 4.6% recorded on October 12th as the UK government’s decision to reverse course on a sizable unfunded fiscal stimulus looked to bolster investors’ confidence. The basic rate of income tax will decrease from 20% to 19% starting in … Read more

Best Forex Broker

MultiBank, the Best Forex Broker L𝐞𝐯𝐞𝐫𝐚𝐠𝐞 and 𝐙𝐞𝐫𝐨 𝐂𝐨𝐦𝐦𝐢𝐬𝐬𝐢𝐨𝐧𝐬 on your commodity trades. ✓ The Only Company to offer 𝐒𝐰𝐚𝐩-𝐅𝐫𝐞𝐞 on CFD shares, including many of the world’s most popular companies✓ The Only Company to offer the 𝐥𝐨𝐰𝐞𝐬𝐭 𝐒𝐩𝐫𝐞𝐚𝐝 on Gold-$0.02✓ 20% Deposit 𝐁𝐨𝐧𝐮𝐬 – up to $40,000✓ Emirates 𝐒𝐂𝐀 Regulated✓ 𝐋𝐞𝐯𝐞𝐫𝐚𝐠𝐞 up to 500:1✓ … Read more

European Stock Markets Advance

After a choppy week, European stock markets advance, with Germany’s DAX 40 rising 1.7% in morning trade and the pan-European STOXX 600 rising 1.6%. Investors ignore higher-than-anticipated US CPI data, the possibility of the Federal Reserve tightening monetary policy more quickly, and news that the European Central Bank will begin unwinding its €5.1 trillion asset … Read more

The British Economy

In August 2022, the British economy shrank by 0.3% month-over-month, following a 0.1% increase in July that was downwardly corrected, and falling short of market expectations for a flat reading. The upkeep of oil and gas infrastructure in the North Sea caused a 1.8% decline in production and a 1.6% decline in manufacturing. Arts, entertainment, … Read more

The Fed’s 75-basis-point rate increase will cause some pain.

Here are some tips for safeguarding your assets and pocketbook. Use the Swap Hunter software to protect your equity. The Fed’s 75-basis-point rate increase will cause some pain. Here are some tips for safeguarding your assets and pocketbook. This represents the Federal Reserve’s third 75-basis-point rate hike this year. The Dow fell around 100 points … Read more