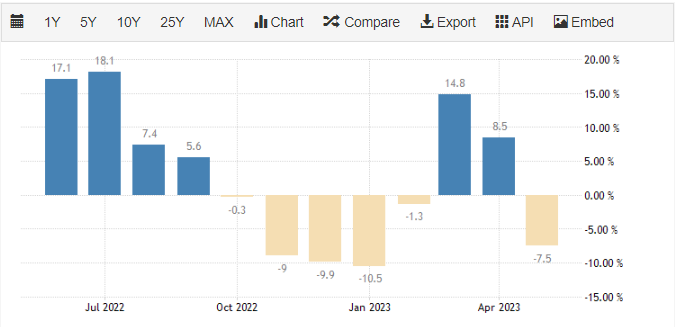

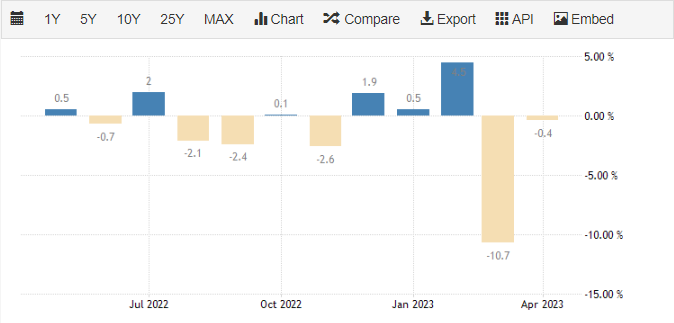

The Turkish lira kept falling, reaching a new record low of 23.5 per USD. This brought the monthly loss to 13% and the overall depreciation since the runoff election on May 28th to nearly 18%. President Tayyip Erdogan named Hafize Gaye Erkan, formerly a co-CEO at First Republic Bank and a managing director at Goldman Sachs, as the head of Turkey’s central bank after Mehmet Simsek, a former deputy prime minister renowned for his market-friendly policies, was named as the country’s new finance minister. These actions were interpreted as a clear indication of a departure from the unconventional economic practices that had resulted in rising inflation, low interest rates, a falling lira, and negative net foreign exchange reserves.

How do we take advantage of this opportunity? How do we mitigate the risk of such a trade?

Answer?

Open an account with with Iron FX and get FREE license or a managed account.

You will be able to get 1:1000 leverage and instant Deposits and Withdrawals and many other benefits.

Get in touch to find out more on on our social media platforms or on Telegram