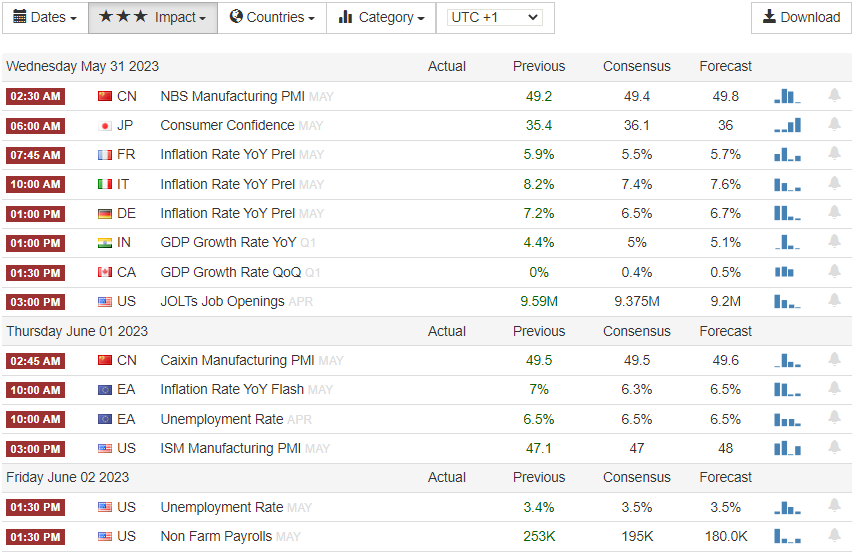

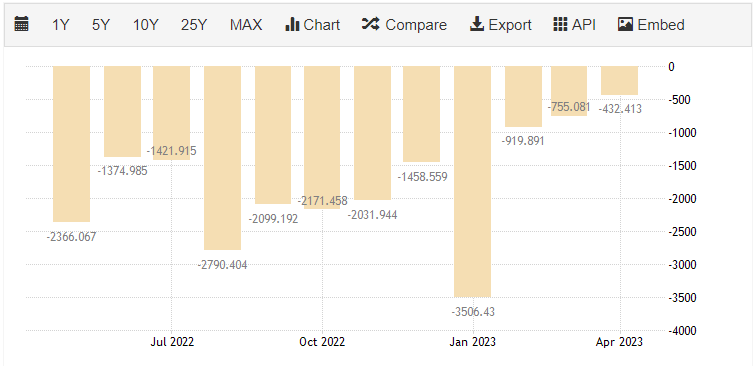

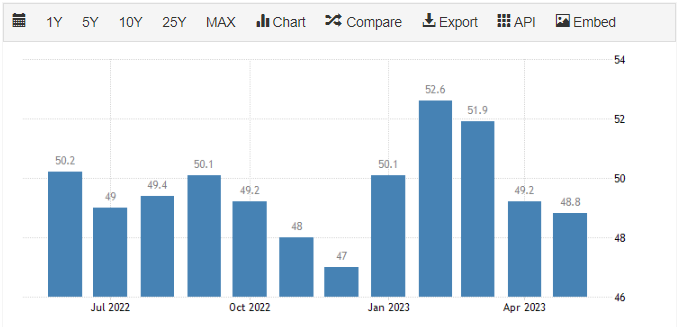

The NBS Manufacturing PMI missed market expectations and dropped to a five-month low of 48.8 in May 2023 from 49.2 in April. The most recent data indicated that manufacturing activity had decreased for a second month in a row due to weak domestic and international demand. For the first time in four months, output decreased (49.6 vs. 50.2 in April), while new orders (48.3 vs. 48.8), purchasing activity (49.0 vs. 49.1), and export sales (47.2 vs. 47.6) also declined quicker. For the third consecutive month, employment decreased (48.4 vs. 48.8). Delivery time was also marginally decreased (50.5 vs. 50.3). On the price front, output charges decreased for the third consecutive month, while input costs decreased at the highest rate since last July (40.8 vs 46.4).

Click here to see how Swap Hunter can maximize your profit potential trading china manufacturing PMI