Rising Bond Yields

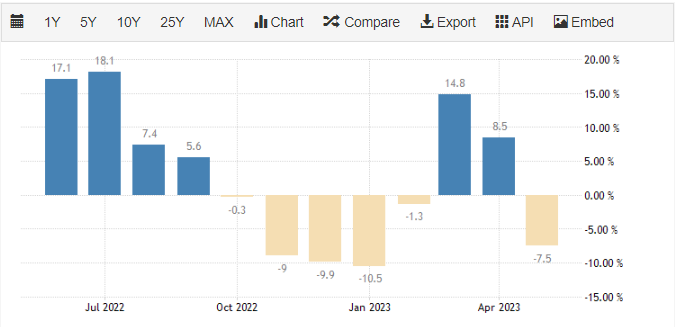

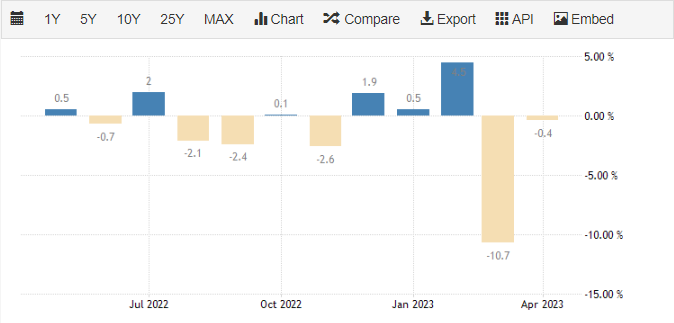

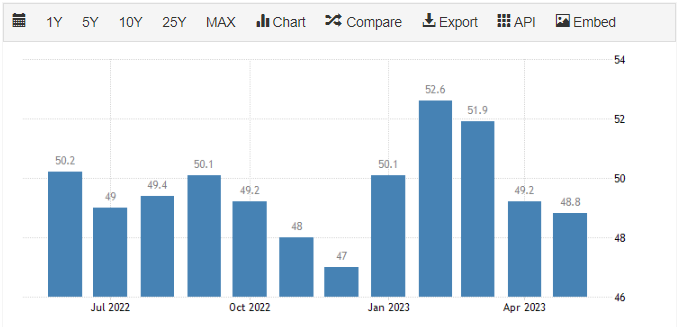

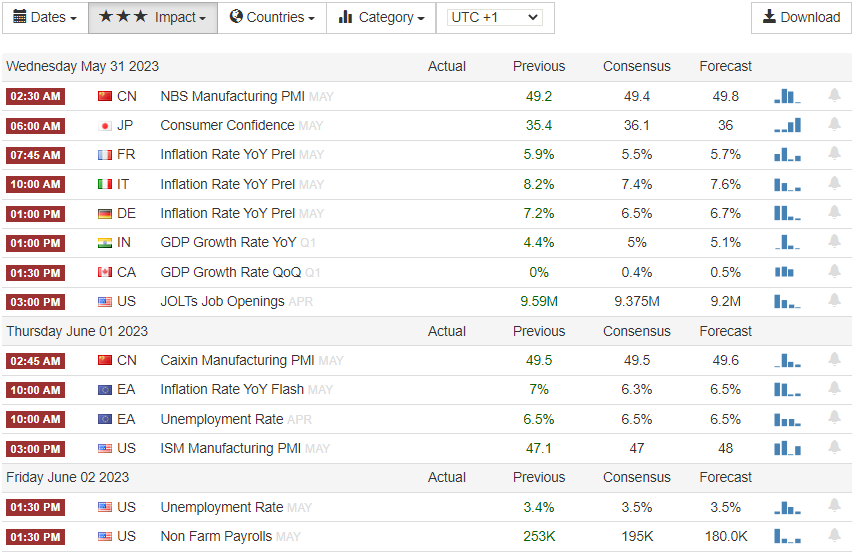

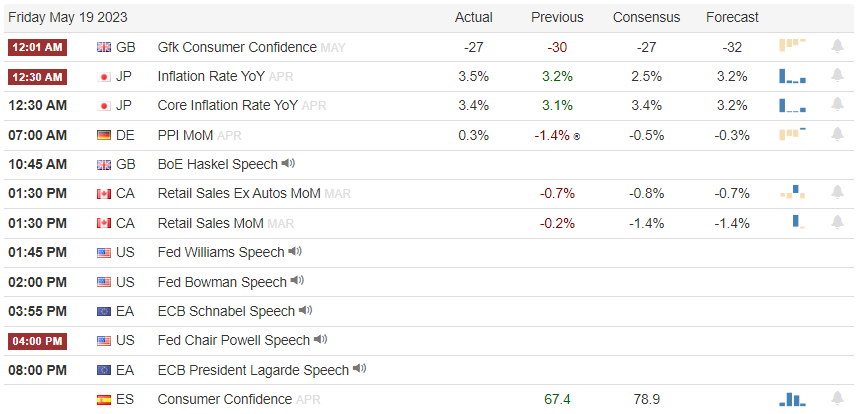

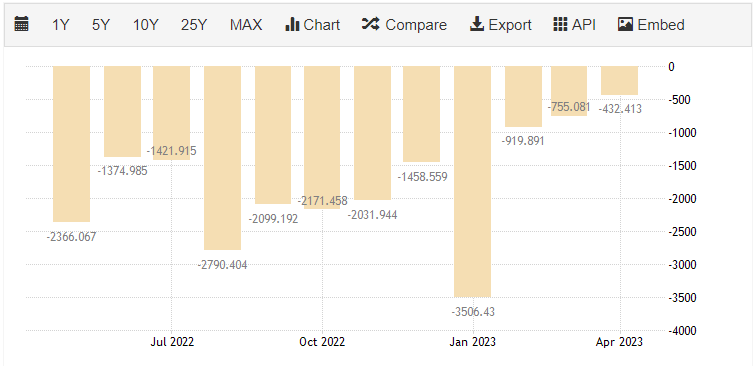

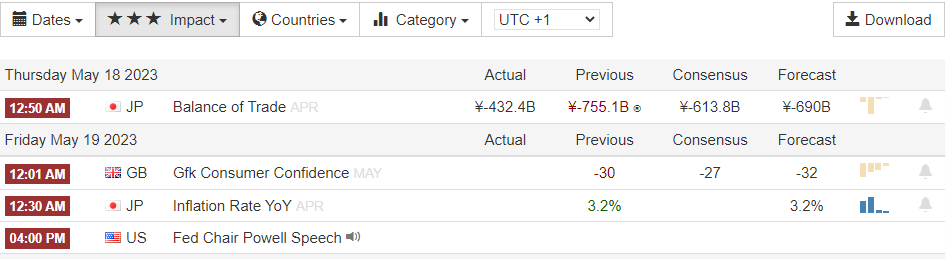

Government bond yields rising globally as investors predicted that high inflation pressures would keep interest rates high. While the Federal Reserve is anticipated to deliver another boost by July, the Reserve Bank of Australia and the Bank of Canada both surprised markets with a 25bps interest rate increase this week.

Trade this type of data, profit from it, don’t let inflation eat your savings.

Join us, become a Swap Hunter

Email us, info@swap-hunter.com

Have the Swap Hunter system explained to you and how it works. Check our recommended broker page.

Open an account with IronfX and get a managed account service, 6 month FREE test of the Swap Hunter system and higher leverage and a 100% trading bonus.

CLICK HERE or on image above.

IMPORTANT

DO NOT BE Re-directed STAY ON THE REGISTRATION PAGE AND COMLETE IT in order to be assigned to Swap Hunter.